Lion has designed a corporate officer compensation system to provide sound and appropriate incentives necessary for retaining outstanding management talent that will achieve the Company’s management policies and continuously increase its corporate value over the medium to long term. Director and Audit & Supervisory Board member compensation is decided by the Board of Directors and the Audit & Supervisory Board, respectively, based on consultations with the Compensation Advisory Committee. Compensation is set within the limits decided by resolution of the General Meeting of Shareholders.

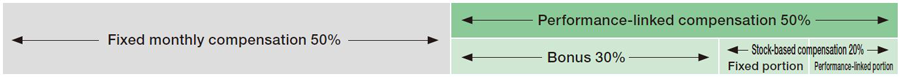

Compensation for directors (excluding external directors) consists of fixed monthly compensation and performance-linked compensation (bonuses and stock-based compensation). It is made up of approximately 50% fixed compensation and 50% performance-linked compensation (30% of which is bonus and 20% stock-based compensation), according to the director’s rank. The proportion of performance-linked compensation increases according to rank and is revised as needed. Fixed monthly compensation is raised or lowered following an appraisal of the results of each director’s management supervision and execution of duties、and the degree to which the director has contributed to addressing the Sustainability Material Issues. Performance-linked compensation is calculated based on the degree to which performance targets have been met in each year and is paid individually at a designated time after the end of the relevant year.

| Type | Performance-Linked Bonus | Performance-Linked Stock-Based Compensation |

|---|---|---|

| Indicators |

Core operating income Profit for the period attributable to owners of the parent |

|

| Total payment amount |

Total payment amount: Sum of (1) and (2) below Note: Rounded down to the nearest ¥10,000. If the result of either calculation is negative, its value is set at 0. |

Total number of points (number of shares) assigned |

| Individual payment amount |

(1) Calculation of payment per point (2) Individual payment amount (3) Points assigned according to rank |

(1) Calculation of number of points

|

| Time of payment | End of March of each year | In principle, shares are issued to directors upon retirement in a number equivalent to the total number of points they have been assigned |

| Upper limit | ¥250 million per year | ¥200 million (per year) Total number of shares.: 120,000 (per year) |

| Clawback clause | No | Yes* |

*In the event of a serious violation of internal rules or professional duties, forfeiture of points already granted or return of the amount equivalent to the shares already received

| Determining Policy | Upper Limit | |

|---|---|---|

| Overview |

|

¥300 million (per year) |

Achievement of targets for core operating income and profit for the period attributable to owners of the parent are as below.

| Indicator | Target | Achievement | Achievement rate |

|---|---|---|---|

| Core operating income | ¥23,000 million | ¥23,559 million | 102% |

| Profit for the period attributable to owners of the parent | ¥20,000 million | ¥21,939 million | 110% |

Compensation for external directors and Audit & Supervisory Board members consists solely of fixed monthly compensation. Compensation levels are set taking into consideration similar levels at other companies and are based on individual roles and responsibilities.

| Number of Corporate Officers | Fixed Compensation (Millions of yen) |

Performance-Linked Compensation | Total (Millions of yen) |

||

|---|---|---|---|---|---|

| Bonuses (Millions of yen) |

Stock-Based Compensation (Millions of yen) |

||||

| Directors (External Directors) | 12 (4) | 287 (45) | 141 (–) | 109 (–) | 538 (45) |

| Audit & Supervisory Board Members (External Audit & Supervisory Board Members) | 5 (3) | 96 (36) | – (–) | – (–) | 96 (36) |

| Total (External Officers) | 17 (7) | 383 (84) | 141 (–) | 109 (–) | 634 (84) |

1.There are no individuals serving concurrently as employees and corporate officers.

2.An upper limit on directors’ fixed compensation of ¥300 million per year was set by resolution of the 156th Annual Meeting of Shareholders held on March 30, 2017. There were nine directors at the closing of this meeting.

3.An upper limit on Audit & Supervisory Board members’ fixed compensation of ¥110 million per year was set by resolution of the 156th Annual Meeting of Shareholders held on March 30, 2017. There were four Audit & Supervisory Board members at the closing of this meeting.

4.Within performance-linked compensation, bonus amounts are calculated and determined based on the core operating income and the profit attributable to the owners of the parent for each year, in accordance with the methods described above. An upper limit for bonuses of ¥250 million per year was set by resolution of the 156th Annual Meeting of Shareholders held on March 30, 2017. There were six directors (excluding external directors) at the closing of this meeting.

5.Within performance-linked compensation, stock-based compensation is the amount obtained by using the share acquisition price to convert the number of points (shares) granted to eligible individuals under the system, depending on the degree of achievement of the Group’s business targets for the year. An upper limit of ¥200 million on the contribution amount of stock-based compensation per year and an upper limit of 120,000 shares on the total number of shares granted per were set by resolution of the 160th Annual Meeting of Shareholders held on March 30, 2021. There were seven directors (excluding external directors) at the closing of this meeting.

6.The amounts shown are rounded down to the nearest million yen.

| Name | Corporate Officer Classification | Total Amount by Type of Compensation

(Millions of yen) |

Total Compensation

(Millions of yen) |

|||

|---|---|---|---|---|---|---|

| Basic Compensation | Bonuses | Performance-Linked Stock-Based Compensation | Retirement Benefits | |||

| Itsuo Hama | Director | 61 | 39 | 31 | – | 131 |

| Masazumi Kikukawa | Director | 61 | 39 | 31 | – | 131 |

Note: Only individuals receiving total consolidated compensation of more than ¥100 million are listed here.